Organic infant Formula Industry Expands | Global Size US$ 36,046 Bn by 2032 | R&D and Premium Global Growth in 2025

Global Organic Infant Formula Market Forecast | Premium & Natural Baby Food Trends to 2032

USA Organic Infant Formula Industry Report | Sustainable Baby Nutrition Fuels 6.3% CAGR Growth”

AUSTIN, TX, UNITED STATES, October 30, 2025 /EINPresswire.com/ -- Organic Infant Formula Market Overview— DataM Intelligence 4Market Research LLP

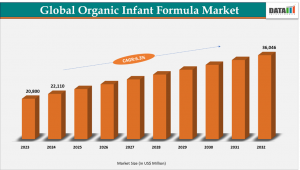

According to DataM Intelligence. The organic infant formula market size was valued at US$ 20,800 million in 2023, increased to US$ 22,110 million in 2024, and is projected to reach US$ 36,046 million by 2032, growing at a CAGR of 6.3% during the forecast period 2025–2032.This strong growth reflects rising consumer awareness around organic nutrition, clean-label ingredients, and sustainable sourcing.

In the U.S., the organic infant formula segment represents one of the fastest-growing categories in baby nutrition. The market is projected to expand from US$ 1.29 billion in 2024 to US$ 3.12 billion by 2032, driven by increasing parental demand for premium, health-oriented options, stricter oversight by the U.S. Food and Drug Administration (FDA), and heightened consumer trust in USDA-certified organic labels.

Globally, brands are shifting toward formulations enriched with omega-3 fatty acids (DHA and ARA), probiotics, and plant-based proteins to cater to millennial and Gen Z parents who prioritize both infant health and environmental sustainability.

Market Size, Share, Outlook

2024 Market Size: US$ 22,110 million

2032 Projected Market Size: US$ 36,046 million

CAGR (2025–2032): 6.3%

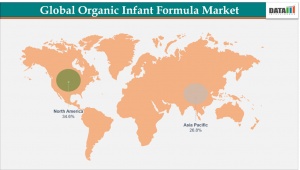

Dominating Market: North America

Fastest Growing Market: Asia-Pacific

Get a Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):– https://www.datamintelligence.com/download-sample/organic-infant-formula-market

Key Industry Developments in the Organic Infant Formula Market (2024–2025)

April 2025: Bobbie launched the first and only USDA-certified organic whole milk infant formula made in the USA, setting a new benchmark for locally produced premium nutrition.

September 2025: Earth’s Best expanded its range of USDA-certified organic, non-GMO cow milk formulas, enriched with DHA and ARA for brain and eye health — emphasizing clean, nutrient-rich options for infants.

2025: a2MC strengthened its China-label infant formula business through a new plant acquisition, signaling rising regional demand for organic and plant-based products backed by strict quality standards.

September 2024: A global Arla Foods Ingredients survey of 6,800 mothers showed growing preference for natural, immune-boosting, and non-GMO formulas, reinforcing the trend toward safe, chemical-free nutrition.

June 2024: Kabrita became the first goat milk formula brand to earn Clean Label Project certifications, highlighting the market’s shift toward pure, high-quality, and transparent infant nutrition.

Market Drivers & Trends

1. Rising Health Awareness and Clean Label Preference

Modern parents are highly conscious about infant nutrition. The American Academy of Pediatrics (AAP) and the Centers for Disease Control and Prevention (CDC) have highlighted the importance of early-life nutrition in cognitive and immune development. This awareness drives the shift from synthetic formulas to organically sourced, non-GMO, hormone-free options.

2. Regulatory Support and Certification Standards

Stringent organic certification standards from FDA and USDA Organic have boosted consumer confidence. Companies must ensure all ingredients are free from synthetic pesticides, antibiotics, and artificial additives, aligning with global organic farming standards set by EU Regulation 2018/848 and IFOAM guidelines.

3. Premiumization and Functional Additives

Parents are increasingly choosing premium organic products with added nutritional benefits such as lactoferrin, human milk oligosaccharides (HMOs), and organic lactose. This premium trend, supported by improved disposable income in developed economies, particularly in the U.S. and Europe, is redefining the market’s growth path.

4. E-commerce and Digital Transparency

Platforms such as Amazon, Target, and Thrive Market have transformed accessibility. Transparent labeling, digital traceability tools, and online parent communities amplify trust and loyalty for leading brands.

Challenges & Restraints

1. Price Sensitivity and Affordability

Organic infant formula is typically 1.5–2 times more expensive than conventional formulas, primarily due to the high cost of organic raw materials and stringent certification requirements. This pricing gap restricts adoption in developing economies.

2. Supply Chain Disruptions

The 2022 U.S. infant formula shortage revealed structural vulnerabilities in global supply chains. Dependence on limited production facilities and strict import regulations can disrupt availability, affecting consumer confidence.

3. Formulation and Labeling Regulations

Complex compliance processes and varying regulatory frameworks across regions (e.g., FDA in the U.S., EFSA in the EU) often delay new product launches. Additionally, maintaining consistent organic integrity from farm to formula remains a key operational challenge.

Key Players

The organic infant formula market is moderately consolidated. Major players include:

1. Nestlé S.A. (Gerber Organic, NAN Organic)

2. Danone S.A. (Aptamil Organic, Nutricia)

3. Abbott Laboratories (Similac Organic)

4. The Hain Celestial Group (Earth’s Best)

5. Else Nutrition Holdings Inc.

6. HiPP

7. Mead Johnson

8. Bellamy’s Organic

9. Holle Baby Food AG

10. Topfer and a2 Milk Company Limited

These players focus on strategic mergers, R&D investments, and supply chain localization. For instance, in 2024, Danone expanded its Irish organic dairy plant to increase output for U.S. and Asian markets, while Else Nutrition partnered with Walmart U.S. to widen its retail footprint.

Get Customization in the report as per your requirements:- https://www.datamintelligence.com/customize/organic-infant-formula-market

Regional Insights

Fastest Growing Industry

Asia-Pacific: Fastest-Growing Organic Infant Formula Market

The Asia-Pacific region is witnessing rapid growth in the organic infant formula market, driven by rising health-conscious parenting, urbanization, and demand for premium, plant-based, and specialty formulas that boost immunity and development.

India – One of the region’s fastest-growing markets, fueled by increasing awareness of infant nutrition, higher incomes, and e-commerce expansion. Parents prefer gentle, plant-based, and hypoallergenic formulas tailored to sensitive diets.

China – Leads the region with a strong shift toward premium and organic products. In 2025, a2MC expanded its China-label formula business with a new plant, underscoring strong demand. Strict regulations and quality standards continue to enhance consumer trust and market growth.

Market Segmentation

By Product Type: (Cow Milk-Based Organic Formula, Goat Milk-Based Organic Formula, Soy / Plant-Based Organic Formula)

By Stage: (Stage 1 – Infant Formula (0–6 months), Stage 2 – Follow-on Formula (6–12 months))

By Form: (Powdered Formula, Ready-to-Feed (RTF) Formula, Concentrated Liquid Formula),

By Distribution Channel: (Online, Offline)

By Region: (North America, South America, Europe, Asia-Pacific, Middle East and Africa)

Buy Now & Unlock 360° Market Intelligence:- https://www.datamintelligence.com/customize/organic-infant-formula-market

DataM Intelligence Insights & Recommendations

According to DataM Intelligence, the next phase of market evolution will depend on three critical levers:

Technological innovation in organic farming and ingredient traceability using blockchain.

Diversification of protein sources, including organic plant and goat milk bases to cater to allergen-sensitive infants.

Strategic partnerships between formula producers and local dairy cooperatives to stabilize supply chains and ensure consistent quality.

DataM recommends that companies invest in regional production hubs, R&D for nutrient fortification, and consumer education campaigns focused on organic transparency. By leveraging digital engagement and certification-based trust, the sector can sustain double-digit growth through 2032.

Related Reports:

Dairy Alternatives for Infant Market

Infant Probiotic Supplements Market

Sai Kiran

DataM Intelligence 4market Research LLP

877-441-4866

email us here

Visit us on social media:

LinkedIn

X

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.