Carbonfuture Announces Landmark 2025 Progress in Building a Scalable, High-Integrity Durable CDR Market

Key partnerships, record carbon removal volumes, new funding, and expanded supply reinforce the foundation for a scalable, high-integrity carbon removal market.

ZURICH, SWITZERLAND, December 15, 2025 /EINPresswire.com/ -- Carbonfuture today highlighted a series of 2025 milestones that underscore continued momentum in its contribution to scaling a trustworthy, durable carbon dioxide removal (CDR) market. Over the past year, the company closed a new funding round, facilitated the world’s first megatonne Biochar Carbon Removal (BCR) agreement, expanded coverage across durable CDR technologies, strengthened its multi-year supply pipeline, and advanced its digital Trust Infrastructure to support growing volumes of high-integrity carbon removal.Closed Strategic Funding Round to Fuel Next Phase of Growth

Carbonfuture closed its Series A2 funding round, led by existing investor SIX, the operator of the Swiss Financial Market Infrastructure, with additional participation from Idemitsu Americas Holdings, a limited partner of Carbon Removal Partners (CRP). This investment strengthens Carbonfuture’s ability to scale both demand and supply globally while further developing the Trust Infrastructure for the current and future carbon markets.

Surpassed 1.5 Million Tonnes Facilitated as Buyer Adoption Grows

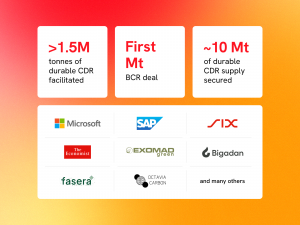

Carbonfuture has now facilitated more than 1.5 million tonnes of durable carbon removal across BCR, BECCS, and DACCS. This reflects continued progress toward multi-year, multi-technology removal supported by rigorous Trust Infrastructure.

In 2025, Carbonfuture also saw strong demand from organizations integrating durable CDR into their net-zero strategies. SIX Group and other financial-sector participants expanded their portfolios through multi-pathway purchases, including DACCS and BCR, while The Economist Group advanced its climate commitments with a durable CDR portfolio backed by Carbonfuture’s Trust Infrastructure. Across technology, finance, and transport, additional buyers acted on their durable CDR commitments through Carbonfuture.

Facilitated the World’s First Megatonne of Biochar Carbon Removal

Carbonfuture facilitated the industry’s first-ever megatonne BCR deal - a 10-year commitment to remove at least 1.24 million tonnes of CO2 - through its partnership with Microsoft and Exomad Green. Every tonne will be tracked with Carbonfuture’s Trust Infrastructure, providing the trust backbone that enables durable CDR to be contracted and delivered at industry scale.

Expanded CDR Technology Coverage and Secured a Robust Supply Pipeline for 2026

In 2025, Carbonfuture broadened the range of durable CDR technologies supported through its Trust Infrastructure. This included two BECCS projects — covering both Carbonfuture’s first Article 6 pilot and its first BECCS tender with Bigadan — as well as four DACCS projects, including a 10-year offtake agreement with Octavia Carbon. Carbonfuture also supported its first Terrestrial Storage of Biomass (TSB) project, which was fully sold out. These advancements extend Carbonfuture’s technology coverage and enable monetization across multi-pathway, multi-year portfolios.

As a result, Carbonfuture enters 2026 with nearly 10 million tonnes of durable CDR supply secured across BCR, BECCS, and DACCS on five continents. This multi-year, multi-technology pipeline — backed by Carbonfuture’s Trust Infrastructure — positions the company to meet growing demand for high-quality durable removals.

Advanced the Trust Infrastructure for Durable CDR With 2025 Enhancements

In 2025, Carbonfuture introduced a range of improvements across its digital Trust Infrastructure to reduce friction for suppliers and enhance transparency for buyers. Updates included faster supplier workflows, expanded methodology support, improved traceability between registries, and a redesigned buyer portal providing unified contract and credit visibility. Carbonfuture also added support for secondary credit transfers, enabling more flexible and efficient portfolio management, as well as a module for managing credit invalidations, substitutions, and buffer pools. This strengthens credit integrity and ensures smooth execution of contract commitments. Together, these enhancements strengthen the operational foundation for durable CDR and help prepare the market for larger transaction volumes.

Contributed to the First Bilateral Article 6 Agreement for Durable CDR Under the Paris Agreement

Carbonfuture contributed to the first bilateral Article 6 agreement between Switzerland and Norway under the Paris Agreement, focused on cross-border CCS and CDR cooperation. As part of a broader coalition of public and private partners, Carbonfuture is participating through a project with Inherit Carbon Solutions, with SIX as a buyer. Carbonfuture is providing digital tracking via its Trust Infrastructure and facilitating the transaction through its marketplace. Pilots of this kind help translate Article 6 provisions into practical operating procedures; while the volumes are symbolic, they establish templates and precedents that other countries can adopt, reducing uncertainty and lowering system-wide risk.

“2025 was a landmark year in the evolution of durable carbon removal,” said Hannes Junginger-Gestrich, CEO of Carbonfuture. “Facilitating the world’s first megatonne deal for BCR, expanding buyer participation, and growing our multi-technology supply pipeline all point to a market that is steadily becoming more scalable, transparent, and investable. With new funding and continued collaboration across the ecosystem, we are well-positioned to help accelerate durable CDR further in 2026.”

Leila Toplic

Chief Communications and Trust Officer, Carbonfuture

+1 206-409-8229

email us here

Visit us on social media:

LinkedIn

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.